In the past 8 years of its enactment, the Insolvency and Bankruptcy Code 2016 (“IBC”) has received a lot of traction as a comprehensive solution towards resolving corporate insolvency and bankruptcy. The IBC regime established itself as an effective solution for addressing banks’ stress by aiding in significantly reducing GNPAs and helping rescue failing corporate debtors. The regulatory body ie., IBBI emerged as the most credible and proactive regulator who earned respect in the shortest span of time.

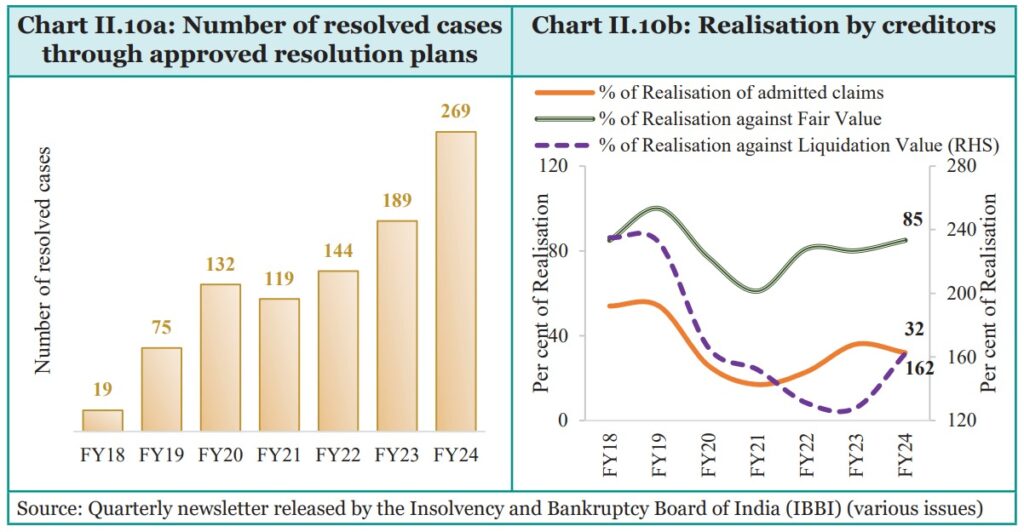

There has been a remarkable increase in the recovery to the creditors in case of bad debts through IBC as compared to its predecessor legislations. The focus which IBC laid on value maximization, promoting entrepreneurship, and balancing the interests of all stakeholders facilitated the revival of the debtors through a credible and matured process well respected and appreciated in the industry. Around 950 resolutions have resulted in a recovery of INR 3.3 lakh crores (roughly 32%) to the creditors.

*Source: Economic Survey 2024-2025

Within this brief period, the corporate ecosystem witnessed several amendments introduced to fine-tune the IBC to the ever-evolving market and its changing demands. The dynamism created more clarity and trust in the process and the problems solved were complicated and without any scope for solution for many years.

The union budget 2024-2025, has promised significant revamping of the IBC for strengthening the Adjudicating Authorities and Appellate Authorities to expedite the insolvency resolution process. Possibly, the Adjudicating Authorities and Appellate Authorities would be endowed with more clarity in the adjudication of matters under the IBC. Several stakeholders also look forward to further process simplification to unclog the delays that crept in through procedural technicalities. Remember always the problem intended to be solved through IBC was complex and was faced with roadblocks which led to a complete deadlock. The dynamism for effective and much-required changes adopted made IBC more effective and trustworthy and treated as a new era legal norm for the future of our country.

Further, the budget also proposes setting up of integrated technology platform aimed at improving the outcomes under the IBC. This is expected to bolster consistency, transparency, timely processing, and better oversight for all the stakeholders under the IBC ecosystem. It is expected that the technology platform will bring in a paradigm shift to how enforcement actions will be carried out.

In this day and age, investing in digital public infrastructure is imperative to keep up with the dynamic technological developments. IBC ecosystem being a significant section of the corporate sector with its impact on a wide array of market participants, incorporation of advanced technological infrastructure can bring some respite to all stakeholders involved.